Vijaya Diagnostic Center share should you hold or sell after listing

Vijaya Diagnostic Center IPO, which opened from 01 Sep to 03 Sept, did not get such a good response from the investors. 14th September 2021, today is the listing date of this IPO. Many investors must be thinking that Vijaya Diagnostic Center IPO Hold and Sell? and Vijaya Diagnostic Center Buy and Sell. Let's try to find these answer of these questions in brief. As you all know that on my website all of you are told before IPO's listing, what to do on the day of listing of stocks and what to do when IPO is listed, what to buy, sell and hold. In the last 'IPO' all the recommendations have been fine. Let us also search the answer of IPO listing of Vijaya Diagnostic Center IPO today.

Also Read: Ami Organics share, buy sell or hold

If we talk about Qualified Institutional Buyers, Vijaya Diagnostic Center IPO got more than 13% subscription. On the other hand, if we talk about non-institutional investors, then only about 1.30 percent Of Vijaya Diagnostic Center IPO share price was subscribed. The repo of retail investors was very less and the portfolio of retail investors was filled only by 1%. If we talk about the employee's subscription, then less than 1% subscription was noted. The price of Vijaya Diagnostic Center IPO in Gray Market is running near 5rs to 7rs i.e. according to IPO Gray Market, today the listing of Vijaya Diagnostic Center IPO is likely to be 527rs to 537rs per share. Retail investors would have got the shares in the Vijaya Diagnostic Center IPO because the retail portfolio had not gone up well. Now the question comes that what should the investors who have got the shares of Vijaya Diagnostic Center IPO do. One answer to this question is Vijaya Diagnostic Center IPO listing if there are some gains to be made then it would be right to exit because Vijaya Diagnostic Center IPO price was already very expensive. The company had brought more than 64 times of its earning IPO price in the market which is very much over priced . Compare this IPO is thought to be listed in the market at face value 1 that too at higher valuations. If we look at this, the medium term gains were already in the IPO price of the company. Therefore, those who have got shares can consider themselves lucky by booking profit, if they get the listing above IPO price of this IPO. For new investors who are looking to buy shares of Vijaya Diagnostic Center, they should wait now. If the share price of Vijaya Diagnostic Center comes down, then allow it to adjust to lower levels and then consider buying considering its risk taking ability. Is. otherwise can be avoided. If traders want to buy at lower levels, then they should buy with strict stoplosses or else completely avoid will be correct. There are other listed stocks in the market which can give good returns, those can be looked at.

Brief about Company:

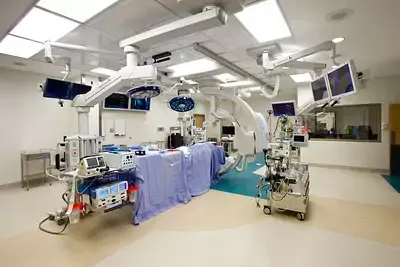

Vijaya Diagnostic Center has a certified group of more than 2200 experts comprising of a portion of the nation's top radiologists, pathologists and healthcare experts. This has empowered arranged diagnostic administrations that assist us in setting up trust and dependability with our patients.

Dr. S. Surendranath Reddy established Vijaya Diagnostic Center in 1981. In the beyond forty years, Vijaya Diagnostic Center has continually run after giving magnificent quality all through the entirety of its focuses and has been the pioneer in utilizing the furthest down the line mechanical patterns to convey top tier healthcare to its patients. Today, Vijaya Diagnostic Center has extended to more than 63 Centers in Hyderabad, notwithstanding different branches in Sangareddy, Warangal, Hanmakonda, Karimnagar, Nizamabad, Kurnool, Nellore, Visakhapatnam, Kolkata and Gurgaon.

Please do not enter any spam link in the comment box.